E - PAPER

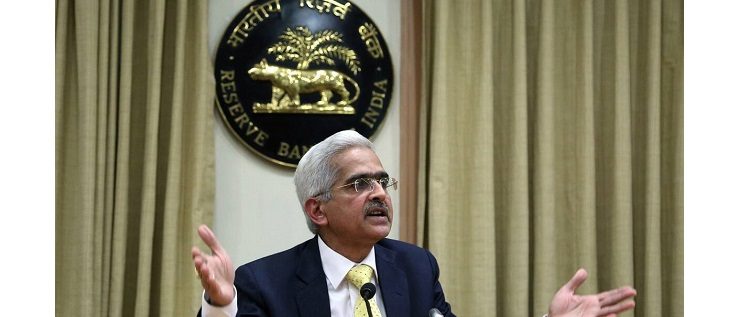

RBI’s Accommodative Policy Stance Augurs Well for Realty

In its latest monetary policy meet, the RBI maintained status quo and continued with the accommodative policy stance which, industry experts and realtors felt, was in line with expectations and will act as a catalyst for economic growth. “The low interest regime and adequate liquidity into the sy

BY

Realty Plus

BY

Realty Plus

Published - Wednesday, 08 Dec, 2021

In its latest monetary policy meet, the RBI maintained status quo and continued with the accommodative policy stance which, industry experts and realtors felt, was in line with expectations and will act as a catalyst for economic growth.

“The low interest regime and adequate liquidity into the system are critical to further strengthen the domestic market. Even while the RBI has announced measures to further mop up excess liquidity, it has also convinced that adequate liquidity will be maintained as required. We hope, the monetary policy announced today will help maintain the economic growth momentum even in the wake of the new variant Omicron,” said Shishir Baijal, Chairman & Managing Director, Knight Frank India.

“The RBI decision will support the revival of businesses sensitive to interest rate movements. The last couple of quarters have witnessed improved and strengthened investment and consumer sentiments; and low lending rates will be the biggest factor in further augmenting the economic growth and kick-starting the stagnant business activities, including real estate,” said Mohit Goel, MD, Omaxe Ltd.

Manju Yagnik, Vice Chairperson, Nahar Group and Senior Vice President, NAREDCO stated, “With the RBI keeping the repo rate unchanged for the 9th consecutive time, homebuyers can still continue to enjoy the low-interest rates on their housing EMIs. The increased affordability due to unchanged Repo Rate, developer offers and schemes, festival benefits has worked in the favour of developers with the sector recording growth of 15 – 20% over the last few quarters."

Anshuman Magazine, Chairman & CEO, India, South-East Asia, Middle East & Africa, CBRE mentioned, “The RBI’s decision to maintain the repo and reverse repo rates steady at 4% and 3.35% has come at a time where economies across the globe prepare to deal with the uncertainties owing to COVID-19’s Omicron variant. While keeping an eye on inflation levels, the RBI’s focus remains on ensuring a durable and self-sustaining economic growth, thereby underscoring the importance of policy support."

Commenting on the news, Rohit Gera, MD, Gera Developments said, “ The decision to keep the key rates unchanged is very welcome for the entire real estate sector where sales have restarted but have been hit on account of the omicron mutation. An increase in the interest rate at this stage would be detrimental for the recovery of the sector.”

Reeza Sebastian, President, Residential Business, Embassy Group shared, “The RBI’s decision on keeping the repo rate of 4% unchanged comes as a positive move at a time when the economy is on its road to recovery. For home buyers, this decision will help reinstate confidence and further the access to affordable home loans. The unchanged repo rate will also aid in infusing liquidity into the sector and in turn, fast track the growth of the residential real estate market.”

RELATED STORY VIEW MORE

TOP STORY VIEW MORE

Mixed Outlook for Australia's Housing Sector In 2024

Mixed Outlook for Australia's Housing Sector In 2024

05 December, 2024NEWS LETTER

Subscribe for our news letter

E - PAPER

-

CURRENT MONTH

LAST MONTH