E - PAPER

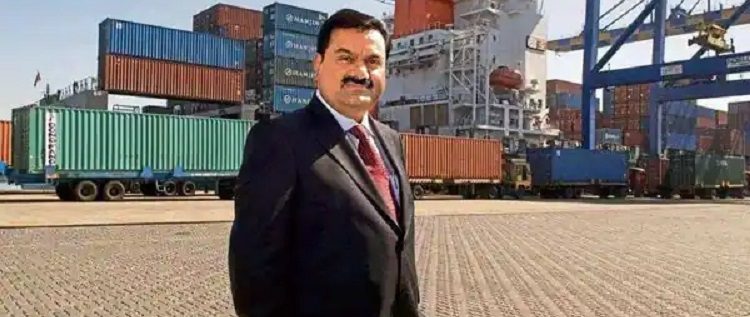

Adani Eyes Asset Reconstruction Biz In Infra & Real Estate

Adani Group has applied for a licence from the Reserve Bank of India to open an asset reconstruction company (ARC) that will acquire distressed assets in infrastructure and real estate. The plan has been in the making for at least eight months, and the application was filed earlier this year. The

BY

Realty Plus

BY

Realty Plus

Published - Sunday, 07 Nov, 2021

Adani Group has applied for a licence from the Reserve Bank of India to open an asset reconstruction company (ARC) that will acquire distressed assets in infrastructure and real estate.

The plan has been in the making for at least eight months, and the application was filed earlier this year. The group is waiting for the nod from RBI. The ARC will buy bad loans in distressed entities where the group has a strategic interest.

The Adani Group owns Adani Capital, a non-banking financial company (NBFC), which is allowed to purchase bad loans under RBI norms. However, using an NBFC for this purpose would lead to the accumulation of NPAs in its book; so typically, corporates set up special purpose vehicles for buying NPAs. Generally, most bad assets on sale are bought by ARCs.

In the past two years, the Adani group has profited significantly by acquiring distressed assets in infrastructure, specifically ports. Its flagship company—Adani Ports and Special Economic Zones Ltd (SEZ)—in February completed the acquisition of Dighi Port Ltd under the Insolvency and Bankruptcy Code for ?705 crore. In 2021, it bought the Krishnapatnam and Gangawaram ports. With these additions, Adani Ports now controls 30% of India’s port traffic. The Adani group acquired a controlling stake in Mumbai International Airport Ltd (MIAL) after its debt burden became unsustainable, and the company attracted a Central Bureau of Investigation (CBI) investigation.

The group’s real estate business housed under Adani Realty is involved in the development of residential and commercial real estate projects spanning 69 m sq. ft in Mumbai, Ahmedabad, Gurgaon, Kochi and Mundra.

RELATED STORY VIEW MORE

NEWS LETTER

Subscribe for our news letter

E - PAPER

-

CURRENT MONTH

LAST MONTH